Where will GOP tax plan hurt the most home owners? I've got data on that, too (Hint: Sorry, Jersey)

More than half the homeowners in five New York-area counties, and half of owners in one county in Virginia and New Mexico, would face a tax increase under the Republican tax plan unveiled this week because it would limit local property tax deductions on federal taxes. Roughly one-quarter of homeowners in another 20 counties around the country would also see an increase, according to data provided to me by ATTOM Data Solutions.

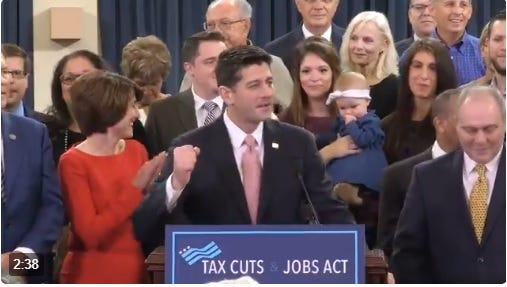

The GOP tax plan released last week takes aim at a series of tax deductions. Included on the chopping block: student loan deductions and a provision that allows teachers to deduct out-of-pocket expenses for school supplies. Other changes would eliminate deductions for local taxes, like property taxes, and cap the mortgage interest deduction. Republicans say an increase in the standard deduction would make up for the changes, but that depends on many other individual factors.

Last week, I published a detailed list of places where the mortgage interest deduction cap would hit hardest. That list has some overlap with today's list of places where ending the property tax deduction amounts to a large tax increase for many homeowners.

Property taxes paid over $10,000 would no longer reduce net taxable income on federal taxes, were the proposal to become a law. Effectively, those homeowners would see a tax increase on that line item.

As I said on Friday, tinkering with tax law like this is just a way of picking winners and losers. With this issue, people in the New York City area -- and particularly beleaguered property-tax payers in suburban New Jersey - would suffer mightily.

A stunning 73% of homes in New York's Westchester County have property taxes over $10,000 annually -- the threshold set by the GOP bill.

Half the owners in New Jersey's Bergen County pay more than $10,000 to their local governments in property taxes. So do about that many owners in Essex County, N.J. and Nassau County, on Long Island. In Luna County, New Mexico, 68% or residents do; near Norfolk, Vir., about 55% do.

There's a long list of New Jersey counties where at least one-third of homeowners would pay increased federal taxes because of the new limit on local tax deductions: Somerset, Huntington, Passaic, Morris and Union counties. In Monmouth County and Mercer County, where Trenton is located, about 25% would be hit by the change.

Fairfield County, CT., and Suffolk County, L.I. -- two far-flung suburbs of New York City, would see about one-third of homeowners hit.

In Lake County, near Chicago, 28% pay more than $10,000. It's about 25 % in San Francisco and San Mateo, while it's 35% in Marin County. But plenty of homeowners would get hit outside of big coastal U.S. cities. It's about 20% in Pitkin County, Colorado, near Aspen, and Travis County, Texas, where Austin is located, according to ATTOM's data.

How do you think you'd fare under the Republican tax plan?

AlertMe If you've read this far, perhaps you'd like to support what I do. That's easy. Buy something from my NEW LIBRARY AND E-COMMERCE PAGE, click on an advertisement, or just share the story.