How much money do you really need? Forget retirement, what's your annual number? Let's start with $100K

Click to learn more about The Restless Project

It seems like a simple enough question: How much money does a normal American family need to afford to be...normal? You already know what I'm about to say next: Coming up with a realistic average family budget is fraught with peril. There's obvious geographic problems -- normal in New York City is not normal in Omaha. There's honest questions about what "need" is -- some parents feel their kids need private school, others don't. Is normal a three bedroom house in a leafy neighborhood, or an apartment? So it goes.

A brilliant professor friend of mine named David Cloutier, who is working on a book for Georgetown University Press about luxury, kicked this question around on Sunday. His research addresses the issue that people often confuse need and want, and this leads to all sorts of trouble, including financial trouble. ().

Do you feel stuck? Bob's book offers 8 proven methods to break free. Click for special offer.

Of course he's right -- we all know folks who spend too much on granite counter tops, Wolf ovens, Cadillac Escalades, and a fourth bathroom. On the other hand, I am often in the position of defending middle class Americans who are slowly slipping further and further behind, even while it seems like they make a lot of money. I think they are forced to pay too much money for decent housing near decent schools, and that pretty much wrecks every budget, whether or not they splurge on restaurant food and nice shoes. Add in occasional thoughts about lack of retirement savings and college costs, and you have a lot of restless parents.

Back to this weekend's exercise. David and I discussed what kind of income an American family needs to live a normal, decent life. I want you to help us. Below, I'm going to lay out the framework of a family budget, and I want you to say what I'm missing. Or, what's excessive. There are some ground rules to make the discussion a little more focused, but feel free to break the rules if you like. Just leave an explanation, such as, "Where I live in Columbus, Ohio, a three-bedroom apartment only costs $1,400."

Before we start, a few numbers for context. The median household income in America - the point at which half of households earn more, and half earn less - is right now $53,891, according to Sentier Research, which bases its math on Census data. Of course, that number stacks families in San Francisco against families in Columbia, Missouri, so it's a bit misleading. An interesting starting point, however.

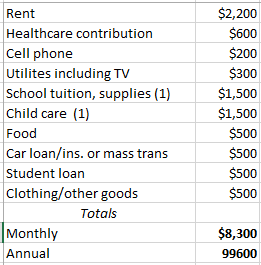

So here goes. For the purposes of discussion, we're talking about a hypothetical four-person household: A married couple with two young children (below 10). We're going to assume both parents work, and that the family must pay for childcare for one while the other goes to a medium-priced private school. They live and work near one of America's largest cities -- Washington D.C., or Seattle, or Chicago. The goal is to come up with a number at which a family of four should feel like it's at least paying all the bills.

To make it simple, we're going to have them rent a 3-bedroom apartment, rather than pay a mortgage, benefit from the mortgage interest tax deduction, but be on the hook for repairs and property taxes. Also to simplify the exercise (admittedly, a bit farcically so) we are describing the amount of money a typical family spends to be normal, which is very different from income, which would be seriously impacted by a variety of taxes: federal, state, and perhaps local income tax -- sales taxes -- auto registration fees, and so on. This is the amount a family needs after all those taxes, and all those tax deductions, are taken into account.

Still, with all these limitations, it seems a worthwhile conversation to have, if for no other reason that it's a good excuse to examine the monthly budget, something few of us do very well. Here's my first stab at it. Note I've gone with big round numbers to make your personal comparisons easier.

When I do my back-of-the-envelope calculation, I come with a nice round number $100,000 of spending power. Also, please note the budget includes nothing for emergency savings or retirement, which should be getting at least another 10 percent or so of this family's money, nor does it consider the money tied up in your home that could be released at a later stage. It also doesn't include emergencies, expenses for elderly parents, or unexpected high-ticket health care costs like braces. Often, to avoid the high fees of unexpected procedures, senior citizens will consider getting some form of dental insurance. Dental insurance and plans are often recommended for seniors since they usually have to deal with higher cost for procedures like root canals, bridges and crowns.

Personal finance columnists keep writing breathless stories about American families not saving for the future -- even "upper-middle-class" families who earn between $75,000 and $100,000 annually. This budget shows why.

One adjustment this hypothetical family might make is for the older child to attend free public school and the younger child to stay home with a parent. That saves $3,000 monthly and lowers annual expenses to $63,600, but it also means the family must live on one income instead of two.

So, what did I forget? What line item is unrealistically high? How does this budget match up with your budget? Tell me below or email me at Bob at BobSullivan.net.

David used actual government data, rather than my guesstimate method, to come up with annual spending breakdowns that are more regional than mine. They range from $36,000 to $76,000. You can read his blog, and see the explanation behind his numbers, here.

Sign up for Bob Sullivan's free email newsletter and follow The Restless Project.