16 cities where renting is a better bargain than buying

January is a natural time to take stock of your financial life, and to dream big dreams about 2018. Could this be the year you make the leap to homeownership? Or, will you make a big change and trade in your mortgage payment for a landlord?

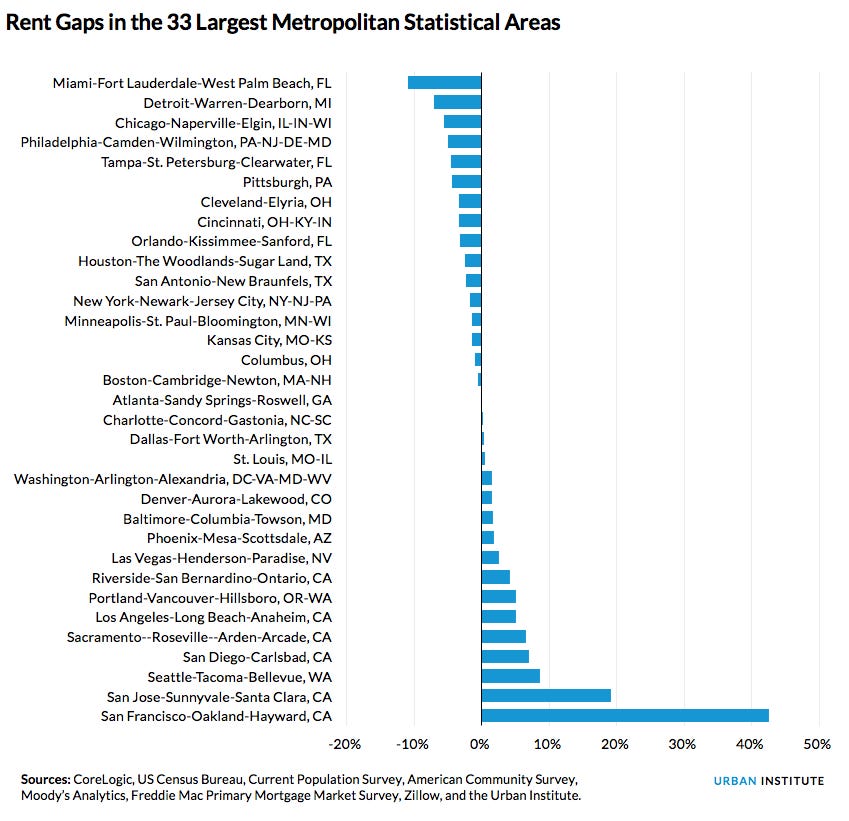

In the complex calculus that’s required for the renting vs. buying decision, one variable stands out: Which is cheaper? If that seems like a hard question to answer, there’s a good reason: crunch the data from America’s largest cities, and you’ll learn it’s a perfectly split decision. According to an Urban Institute analysis, among 33 top metropolitan areas in the U.S., there are 17 places where buying is cheaper, and 16 where renting is cheaper. We’ll get to that list in a moment, but here’s a hint: renters in high-flying West coast cities might want to sit tight for a bit longer.

(This story first appeared on Credit.com. Read it there.)

Renting vs Buying

Fewer life decisions carry more weight than the renting vs. buying dilemma. And that choice is getting harder. A generation ago, buying a home was seen as a rite of passage, a natural (and necessary) step towards adulthood. It was also a solid path to wealth. A $25,000 home purchased in 1970 was worth almost $100,000 by 1990, and about $200,000 today, using national average appreciation. Plenty of baby boomers who bought average-priced homes as young adults find themselves living in a nice nest egg now.

All that changed when the housing bubble burst. Millions lost their homes to foreclosure. Millions more found themselves “under water,” meaning their homes worth less than their mortgage balance. At the height of the housing recession, 23 percent of mortgage holders — nearly 1 in 4 — were under water. They’d lost money on their investment. The myth that housing prices can only go up has been busted. Many of those bubble-era buyers wished they were renting. Flat sharing is also a popular idea of accommodation. Thinking about where to live if you are relocating or move house should be your top priority. Moving to a place like London, depending on the area, can be quite pricey. Find a Flatshare in London if possible. It would be cheaper than living alone or buying a house. There are always people to help you in whatever you wish to invest your money into. So when it comes to your home, you could look into something like a Phoenix mortgage lender, to help you get the right type of loan with the best terms. With an investment like a home, it is best to do your research into anything you don't understand to help make this process easier.

While the housing market has slowly recovered, blind faith in housing gains has not. Homeownership rates hit a 50-year low in 2015, and first-time home buyers are now waiting a record 6 years to move from renting to buying. In fact, young adults looking to upgrade out of their 1-bedroom apartments are increasingly renting single-family homes rather than buying. Single-family rentals – either detached homes or townhomes – make up the fastest-growing segment of the housing market, according to the Urban Institute.

But renting is no picnic either. With all these new renters, markets are reacting accordingly, and costs are now skyrocketing at about four times the rate of inflation. In some places, rents are up much higher. Seattle saw an average of 6.3 percent rent increases last year.

Such volatility in housing and rental prices isn’t the only reason the renting vs. buying equation bas become more complicated. Thanks to structural changes in employment — led by the various form of the gig economy and the contingent workforce — flexibility is key for workers. Gone are the days where a worker could buy a house with a 30-year mortgage and count on a consistent commute for the next three decades. People change jobs much more frequently now. Millennials experience four job changes by age 32, according to a LinkedIn study; they’ll move 6 times by age 30, according to 538.com

While it’s possible to sell a condo or house and move, it’s much easier for a renter to relocate for that great opportunity on the other coast.

Income Driven Decisions

For most people, however, it comes down to money. You might think renting is always cheaper than buying, but that’s incorrect. A long list of variables must be considered when running the numbers, like these: How long will you stay in the place? How much are property taxes? How much investment opportunity cost will you pay when putting a large down payment into a home? How much will you spend on house repairs or condo fees? How much might your landlord raise the rent?

The Urban Institute provides an interesting answer to these questions by comparing the percent of monthly income a buyer or renter would have to spend to own or rent an average home in cities around the country. To ease the comparison, the constants are pretty simple. The report assumes median income, then calculates how of that monthly paycheck would be eaten up by owning – including mortgage payments, interest, taxes, and insurance payments on a median-priced home – or by renting a median-priced 3-bedroom home.

Ordinarily, these costs have to move relatively in sync. When rents get too high, consumers are pushed into buying. The opposite is true, too — when homes/monthly mortgage payments are too high, people are nudged to rent. So these costs tend to move together, or at least like two balloons tied together by a string, floating up into the sky: One pulls ahead for a short while, then the other, and so on. After all, people have to live somewhere.

Cities Good for Renting

But in some cities, these rules don’t seem to apply at the moment, and either renting or buying has sprinted ahead. In those places, you might say the market is broken. The Urban Institute calls this the “rent gap.” In eight large cities in the US — all on the West Coast — the rent gap is higher than 4 percent, meaning it’s considerably cheaper to rent than buy. But on the other hand, there are six major cities spread throughout the East and the Midwest where buying is cheaper, using this monthly costs test. In between are 19 cities where rental and buying costs are basically running neck-and-neck.

The rent gap is most pronounced in places where housing prices have soared. San Francisco is the clear “winner” in the places where renting is cheaper than buying; there, the gap is more than 42 percent. San Jose comes in second at 19%. Seattle, San Diego, Sacramento, Los Angeles, and Portland round out the list of places where the gap is higher than 5 percent.

Cities Good for Home Buying

On the other side of the list — places where buying is cheaper than renting — begins with the winner, Miami.

It would be a stretch to call Miami a bargain, however. A median-priced home still consumes 32 percent of a median earner’s income, above the recommended 30 percent. Still, renting devours even more.

“Because Miami is the second-most-expensive city for rental housing, however, the median rent consumes 42 percent of the median income. So even at this high cost, homeownership is still the better bet,” the report says.

Detroit, Chicago, Philadelphia, Tampa, and Pittsburgh round out the list of places where the rent gap is 5% or more towards buying.

There are buying “bargains” in other cities, too. Cleveland, Cincinnati, Orlando, Houston, and San Antonio all enjoy rent gaps that are more than two percent.

What to Consider

This list comes loaded with caveats, however. The biggest one: Purchasing a home brings the potential of appreciation, and renting does not. That means buyers can “profit” over time and see the value of their investment rise. The longer the time living in the purchased home, the higher the odds that significant appreciation will occur. But don’t forget, transaction costs are significant. Not all those gains are “profit.” Closing costs when buying, and then later when selling, can easily eat up 10% of those gains. Then, there’s always the chance the value of the home will go down, re-creating the situation from the early part of this decade, when buyers lose money. And of course, there’s the variable every homeowner loves to hate, surprise repair costs. Renters generally don’t face that risk.

In the end, the renting vs. buying choice is intensely personal, and always depends on your family’s very specific situation. It’s unwise to ignore macro trends, however. Even if you live in a city where housing costs seem high, it’s worth considering a purchase if rental costs are soaring, too. On the other hand, don’t simply assuming that buying is better. That’s 20th Century logic which no longer applies to the U.S. housing market.